The Mandatory Provident Fund (MPF) is a retirement savings scheme designed to provide financial security for employees in Hong Kong 積金易平台. Introduced in December 2000, it ensures that working individuals save regularly for their retirement. This article covers the key features of MPF, its benefits, contribution rules, and withdrawal options.

What is MPF?

MPF is a compulsory pension system for employees and self-employed individuals aged 18 to 64 in Hong Kong. It is regulated by the Mandatory Provident Fund Schemes Authority (MPFA) and requires contributions from both employers and employees to build long-term retirement savings.

MPF Contributions

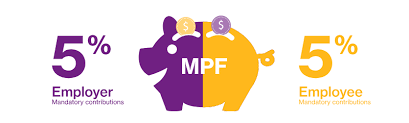

Employer and Employee Contributions

- Employers contribute 5% of the employee’s relevant income.

- Employees also contribute 5% unless their monthly salary is below HKD 7,100, in which case only the employer contributes.

- The maximum relevant income for calculating contributions is HKD 30,000, meaning the highest mandatory contribution is HKD 1,500 from both employer and employee.

Self-Employed Individuals

Self-employed persons must also contribute 5% of their income, which can be paid either monthly or annually.

MPF Investment Options

MPF contributions are invested in different funds, and members can choose their investment strategy:

- Equity Funds – Higher-risk investments focused on stocks for long-term growth.

- Bond Funds – Lower-risk investments that generate stable returns.

- Balanced Funds – A mix of stocks and bonds to balance risk and return.

- Conservative Funds – Low-risk investments with minimal fluctuations.

- Default Investment Strategy (DIS) – A standard option that adjusts investments based on age.

Benefits of MPF

- Retirement Savings – Ensures financial security after retirement.

- Employer Contributions – Employers are required to contribute, increasing total savings.

- Tax Benefits – Employee contributions are tax-deductible up to a certain limit.

- Flexible Investment Choices – Employees can select their preferred investment funds.

- Transferability – MPF funds can be transferred when switching jobs.

MPF Withdrawal Rules

MPF funds are usually available when the employee reaches age 65. However, early withdrawal is allowed under certain conditions:

- Permanent departure from Hong Kong

- Early retirement (at age 60)

- Severe illness or total incapacity

- Death (funds will be given to beneficiaries)

Conclusion

The MPF system plays a vital role in ensuring financial stability for retirees in Hong Kong. By understanding contribution rules, investment options, and withdrawal conditions, employees and self-employed individuals can make informed decisions to maximize their retirement savings. Managing your MPF effectively is key to securing a comfortable future.